Lennar Homes Land Banking Application

-

Role

UX Designer / Researcher

-

Duration

3.5 months

-

Tools

Figma, Miro, Jira, Microsoft PowerPoint

Note to Hiring Manager

Due to signing an NDA (Non Disclosure Agreement), The complete Wireframes and Prototypes cannot be shared.

Overview

Lennar Homes partnered with Infosys to digitize their Land Banking process, which was previously managed through manual paperwork and Excel sheets. The new platform was designed to allow bankers to add candidates, approve or reject loans, and track project finances and progress in a centralized, user-friendly system.

Problem

Inefficiency

slow processing times and high error rates.

Lack of transparency

difficult for bankers to track loan status and candidate progress.

Scalability issues

growing volume of projects made Excel and paperwork unsustainable.

My Role

Researched existing workflows to understand how users interacted with manual forms and spreadsheets.

Designed digital flows (Preparer & Approver) to replicate necessary steps while removing redundancies.

Created prototypes for dashboards, approvals, and financial tracking that simplified complex tasks.

Led usability testing and refined designs, achieving strong stakeholder buy-in.

Process

-

Research

Mapped out the manual paper + Excel workflows to capture user pain points.

-

Journey Mapping

Created digital equivalents for Preparer and Approver flows.

-

Wireframing & Prototyping

Designed dashboards that consolidated candidate information, approvals, project updates, and loan tracking.

-

Testing & Iteration

Improved clarity, reduced clicks, and ensured the flow matched bankers’ real-world processes.

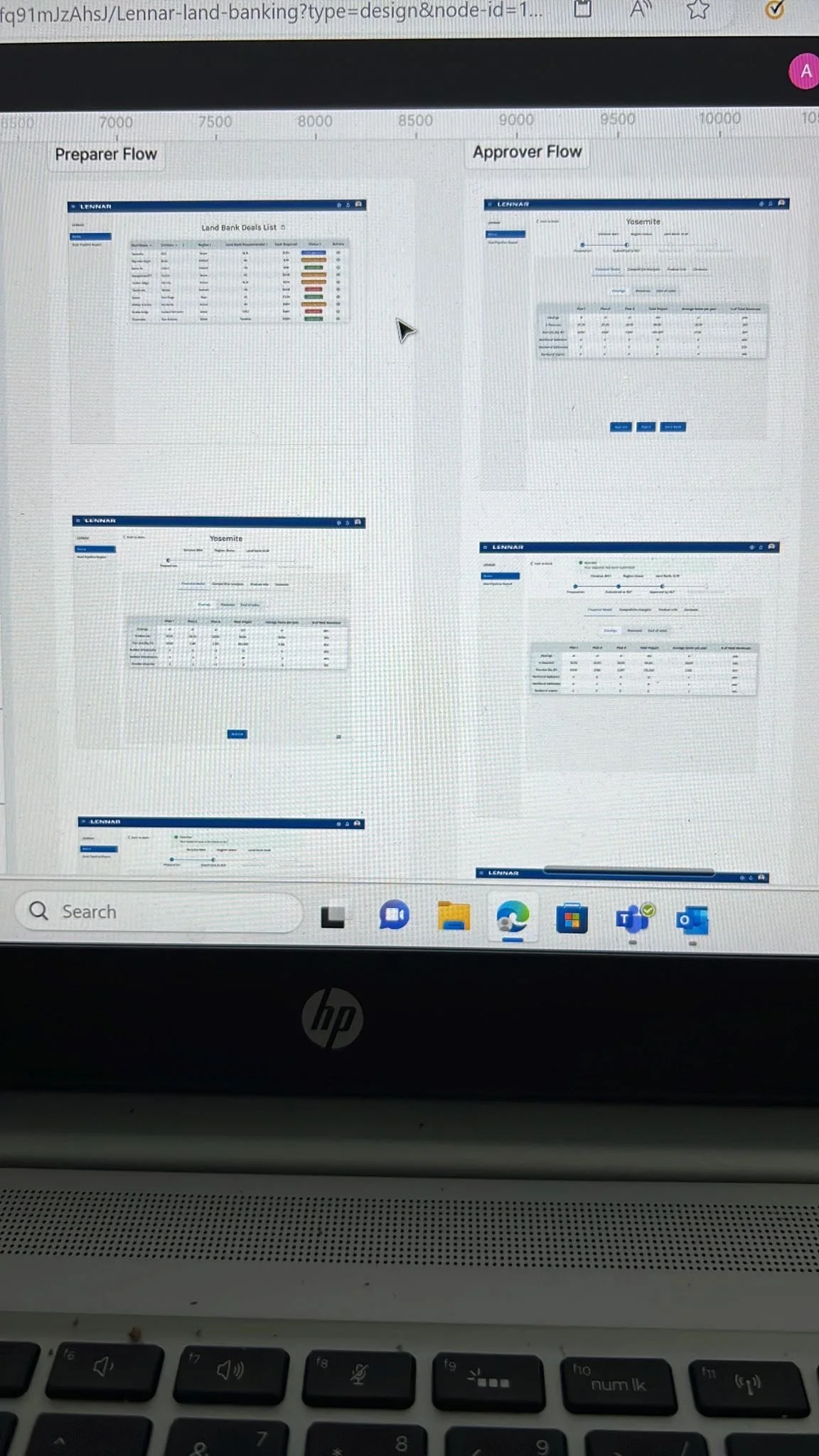

Wireframe & Prototyping

Designed mockups to digitize Lennar’s manual land banking process, focusing on the Preparer Flow, Approver Flow, and Tracking Dashboard. These explorations helped align stakeholders around a simpler, more efficient workflow.

⚠️ Note: Due to NDA agreements, full wireframes and prototypes cannot be shared.

Impact

Replaced manual paperwork and Excel sheets with a digital platform, reducing approval cycle time.

Improved customer satisfaction by 20% through streamlined digital workflows.

Provided bankers with a single source of truth for candidate approvals and financial tracking.

Reduced release delays by 10% by aligning with developer handoff processes.